National think tank critical of taxation rates here and in Canada’s Atlantic provinces

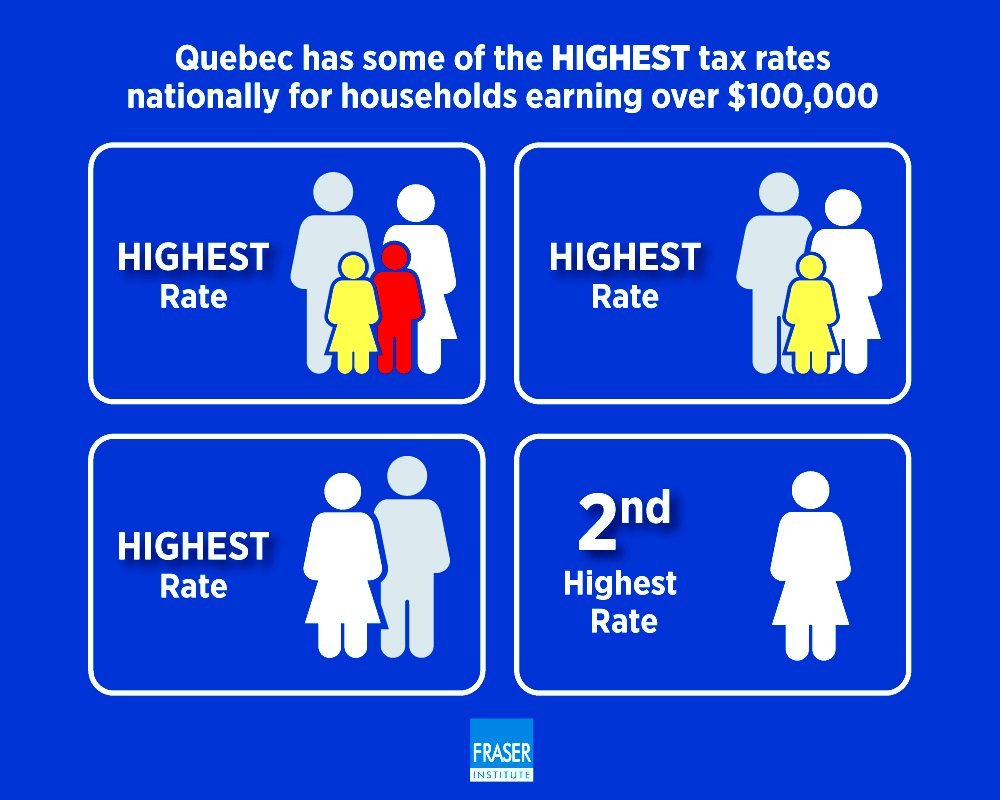

According to findings in a new study conducted by the Fraser Institute, Quebec and eastern Canada have the highest personal income tax rates nationwide on individuals and households that earn $100,000 or more a year.

High earners in Western Canada

The report found that authorities in Western Canada, by contrast, tax high income earners at lower rates and have higher numbers of those earners.

“There is clearly an east-west divide in Canada, with Quebec and Atlantic Canada having the highest income tax rates on high-income earners, and the lowest share of high-income tax filers,” said Alex Whalen, policy analyst at the Vancouver-based think tank, who co-authored the report.

Few $100K earners here

The study found that couples with no children, couples with one child, and couples with two children in Quebec had higher personal income rates than anywhere else in Canada. Single people in Quebec who made more than $100,000 had the second highest personal income tax rate nationwide after Prince Edward Island.

Crucially, of the 10 Canadian provinces, Quebec had the seventh lowest percentage of tax filers who earned $100,000 or more a year in income, and again, the Atlantic provinces also were at the bottom of the pack for share of tax filers who earned more than $100,000.

Few high-income earners

“The situation in Quebec and the Atlantic provinces is clear – the jurisdictions in Canada with the highest personal income tax rates on high-income earners also have the lowest share of high-income earners nationwide,” said Whalen.

“Given that high income earners are often entrepreneurs, job creators, or other high performers, policymakers in Quebec and eastern Canada should consider personal income tax reform in order to make their tax regimes competitive with the rest of the country.”

Only Quebec was higher

Some patterns and themes emerged in the report. Among other things, Quebec applies the highest effective personal income-tax rates in Canada, closely followed by Newfoundland & Labrador, Nova Scotia, Prince Edward Island and New Brunswick.

In the report, titled ‘High Tax Rates on Top Earners in Atlantic Canada and Quebec,’ the authors said that when looking at couples with one child and income over $100,000, Newfoundland & Labrador stood out as the Atlantic province with the highest rate, at 25.4 per cent. Only Quebec was higher at 26.5 per cent.

Atlantic Canada taxes

In their conclusion, the authors wrote, “The data presented show that the four Atlantic Canadian provinces generally impose higher effective personal income-tax rates than the Canadian average across various high-income thresholds and across various family types, including unattached individuals, couples with no children, couples with one child, and couples with two children.

‘There is clearly an east-west divide in Canada, with Quebec and Atlantic Canada having the highest income tax rates on high-income earners’

“In other words, Atlantic Canada’s personal income-tax burden is consistently above average for Canadians earning high incomes. The region also generally has, along with Quebec, the lowest share of Canadians earning above $100,000 compared to Central and, particularly, Western Canada.”